STARTUP WATCH – massUp: plug & sell

admin

- December 2, 2016

Selling niche insurances without loads of paperwork: That’s the idea of massUp:

The white-label platform, financially backed and developed by mediaman, enables brands and merchants to insure their products in the intermediary market. mediaman CEO, Armin Bieser, speaks with us about how the idea for this project came about:

Armin Bieser: The idea evolved from a dialogue with potential and existing clients. mediaman’s orientation towards digital business solutions means that in creative thinking workshops and joint brainstorming we try to find out where there are opportunities for our clients. massUp:, for example, is a product in which we found such an opportunity. We saw a need which is why we developed this white-label platform for brokers in Germany.

mm Shanghai: This means in the case of massUp: mediaman identified the need and demand in this sector by communicating with clients?

Armin Bieser: Yes, and in the dialogue with potential clients. But this time it is different from our service business where we normally get an order and implement this order. We now invest more in our own digital projects, in which we also see opportunities for ourselves. With higher risks, no doubt. In the case of massUp: we developed a platform independently, which we will launch this year. The platform will improve processes. It quasi reflects our DNA: the optimization of digital processes and business models. And it will help the client to work more efficiently. We already have broker organizations and interested parties who will offer products from this platform to their clients.

mm Shanghai: “Interested parties” means that the product has already started off well. Which stage is the project in?

Armin Bieser: Of course, the project first had to pass a financing phase. You have to plan the investment for such a product and a business plan has to be developed. This is what we did already. We found partners who are interested. We went live at the beginning of the year and now we will enter the market and the sales process with our first products. We will find new sales organizations that can use the white-label platform; or some modules from it.

mm Shanghai: Tell me a little about how massUp: works.

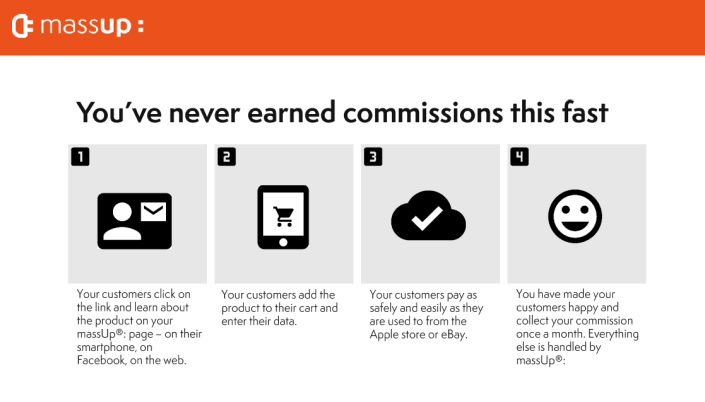

Armin Bieser: The white-label platform enables partners to sell low margin financial products online. Instantly deployable across all digital channels and devices. massUp: carries out the complete processing: from request, online payment to contract validation and commission payoff. More than 150 annex and niche insurances are made available via digital interfaces. Thus, even micro insurances become profitable.

mm Shanghai: Within the first three quarters of 2015 insurance tech startups have already attracted more than three times as much funding as in 2014 and more than 247% from 2013. A huge share of this money is going into young companies (Seed/Series A investments). What does this look like for massUp:’s growth internationally?

Armin Bieser: In international markets, besides US, we are happy to see that Germany along with the UK is leading in early stage insurance technology deals from 2011-2015. And with China’s ZhongAn Insurance we are well positioned in a market with the best funded startup in this space worldwide. On top of that, there are many high quality studies that predict the disruption of the $300 billion insurance industry such as the one from Deloitte. Facts, trends and experience give us confidence that now is the right time to be digitally active in the insurance space.

mm Shanghai: Do you think that massUp: is also interesting for the Chinese market?

Armin Bieser: Since the insurance market here is, in general, relatively underpenetrated: definitely! As with ZhongAn Insurance, first steps are being made in regard to taking insurance to a new level and make them accessible online. Foreign players such as Allianz are positioning themselves together with Baidu or trying to get into similar partnerships.

While it may be too early to tell whether or not the local market is ready or will ever be ready to protect gadgets such as an iPhone or one’s bike. Special products, such as one from a Chinese insurance in cooperation with the Smartphone brand Xiaomi, pave the way for a broader acceptance. Besides a broad acceptance, insurers need to be willing to move fast and put products out in the market. New market entrants such as Zhongan are leading in this regard and insurance for your drone has been structured and can be purchased here already.